The data from the Philippine Statistics Authority (PSA) during the Save Lives #SlowDown road safety campaign in 2017 has detailed that an average of 34 Filipinos dies from a vehicular accident daily. Accordingly, the Metro Manila Development Authority (MMDA) has recorded more than 75,000 road accidents between January and September of 2019.

Even when drivers employ safety precautions when driving on the roads, they still get involved in a car accident. Though drivers’ silly mistakes cause some minor car blunders, many incidents, particularly the major car accidents, happen because of other drivers’ ignorance and reckless acts.

As accidents can happen anytime, drivers need to get insured. Car insurance is a type of non life insurance Philippines that financially protects a driver from any expenses incurred from a car accident. Although many Filipinos think an insurance policy is a financial burden, having a specific type of auto insurance is compulsory.

Consequently, people living in Quezon City and are traveling through the north’s busy roads, including EDSA, need to secure a car insurance Cubao, as these roads are not exempted from vehicular accidents, which can occur at any time.

Various insurance companies offer car insurance policies at different rates. Hence, car owners need to compare car insurance Ph to know which policy and premium rate best suits their lifestyle. Comparing car insurance policies allow vehicle owners to select the right premium rate, which they can consistently pay.

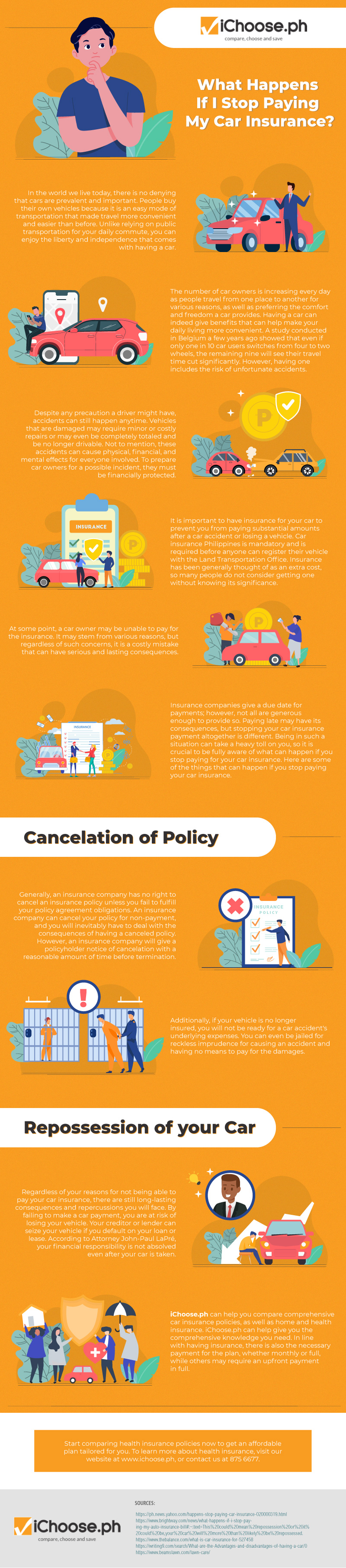

Like other utility bills an individual pays, car insurance premiums also need to be paid consistently. Failure to pay for the insurance on the given due date can have severe and lasting consequences that can have a heavy toll on the car owner.

Car owners paying their premiums later than the given due date may have consequences, such as an interest rate, depending on the insurance provider’s regulations. However, stopping their car insurance payment is different. They can have their policy canceled, which means their vehicle is no longer insured, and they have to pay for the expenses and damages from a car accident.

Repossession of the car can also be a repercussion a vehicle owner can face. Their creditor or lender can seize the vehicle if the owners have their loan or lease and car insurance at default, as many lenders require owners to acquire an insurance premium to have it protected in case it gets involved in an accident. This infographic from iChoose PH further discusses what happens when car owners stop paying their car insurance policies.